Objętość 250 stron

0+

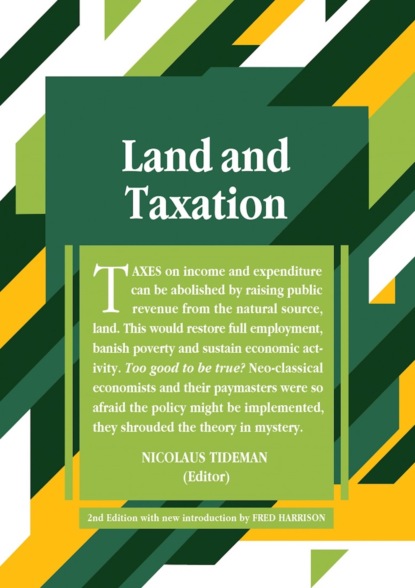

Land and Taxation

O książce

With an updated introduction by Fred Harrison, Shepheard Walwyn has now published this classic book as an eBook.

Economists know that the optimum conditions for private enterprise are achieved when taxes on the earned incomes of labour and capital are reduced to zero but, because neoclassical economic theory insists on treating land as capital, they dismiss the obvious alternative to taxing labour and capital – the unearned income from land.

Mason Gaffney explains the importance of recognising land as a distinctive factor of production and the consequences of its uniqueness for economic policy, for example, that income from land is subject to market forces quite different from those that determine a return on capital. Nic Tidman brings together the classical literature on land taxation to explain the argument that such taxation is an economically efficient and ethical revenue source.

The authors argue that reform of the structure of public finance would make it possible to restore full employment without causing inflation and to reduce the overall tax burden. Once again, Shepheard Walwyn presents a different approach to an old problem.